Transform Your Pitch Deck into Millions of Dollars.

Attract capital through professionally designed pitch decks and offering memorandums for real estate and startups, created by experienced founders and investors ourselves.

Your Pitch Deck Partner For Fundraising Success

We are investors and founders ourselves.

We understand investors and communicate your unique value proposition through VISUAL STORYTELLING to help your business attract capital.

Portfolio Gallery

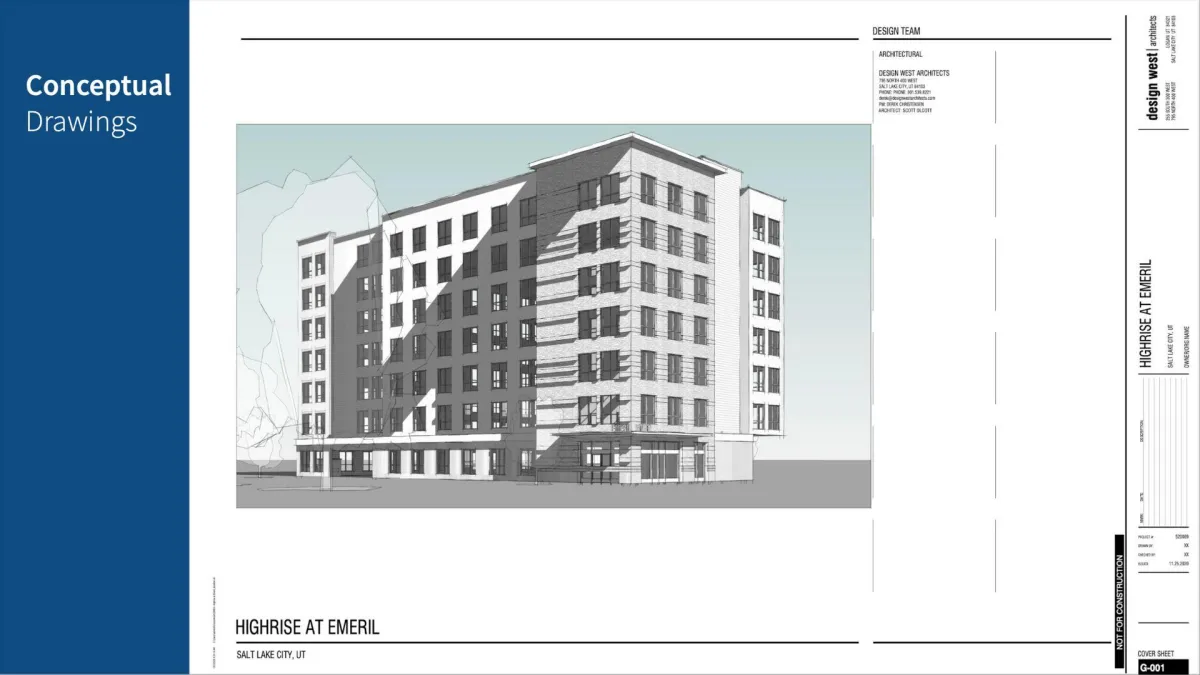

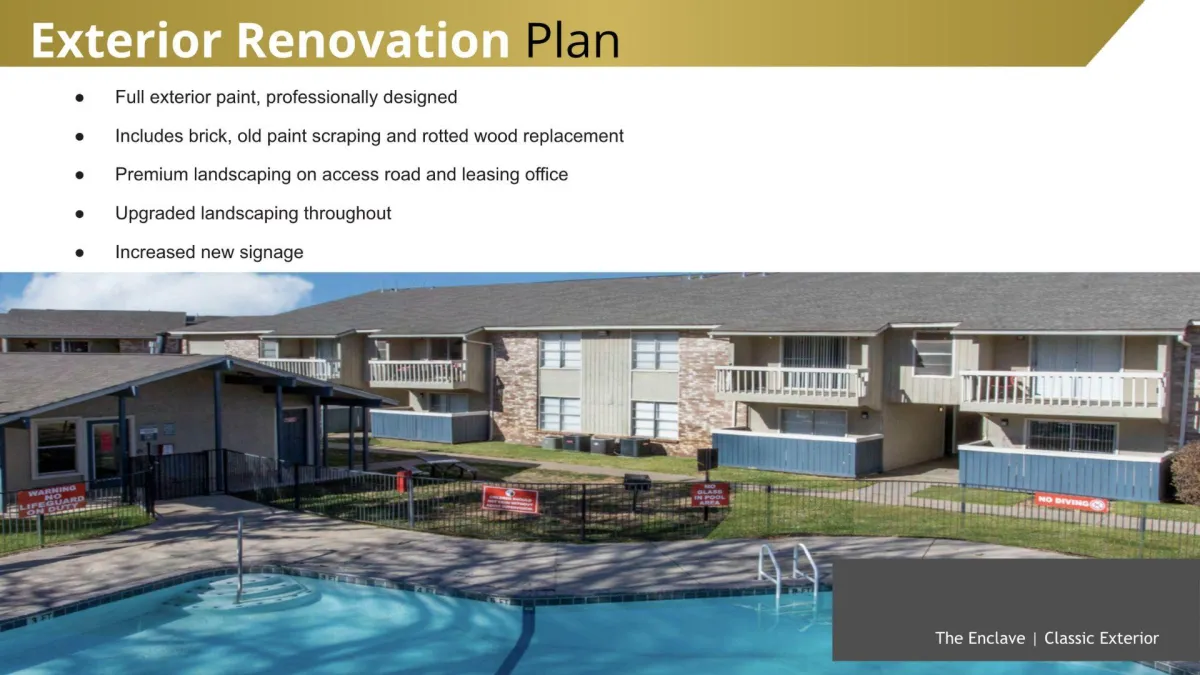

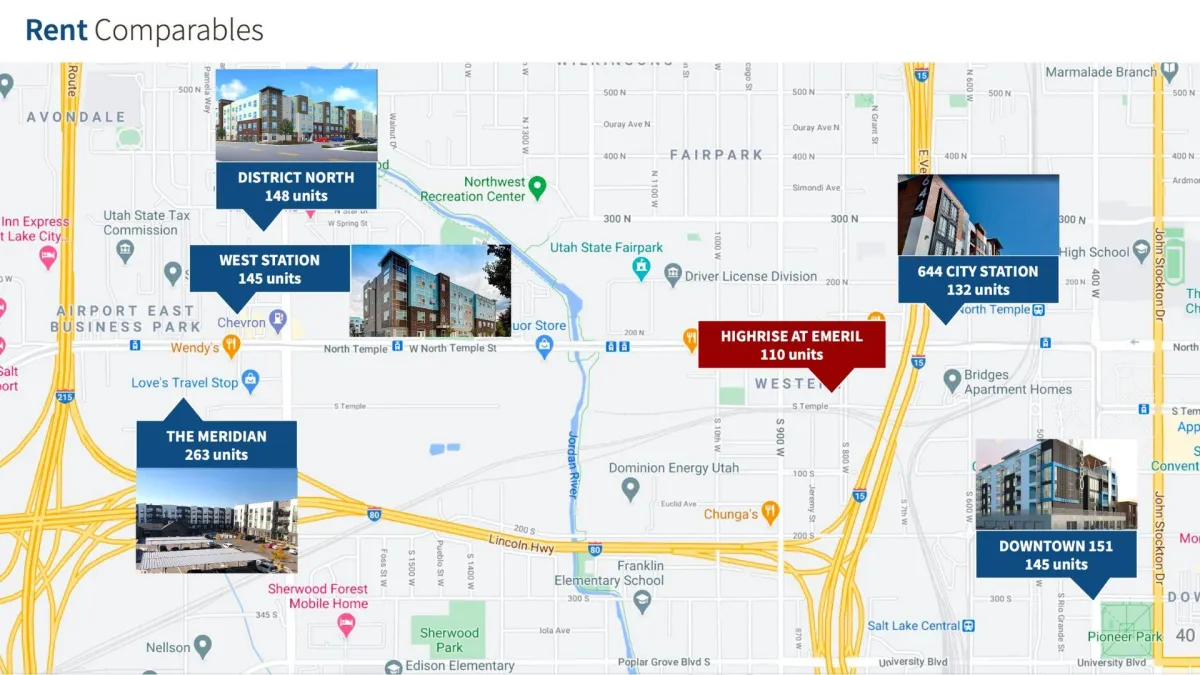

Commercial Real Estate

We are not just graphic designers: we own and operate a commercial real estate portfolio of nearly 1,000 units nationwide.

Our hands-on experience attracting investor capital combined with our visual storytelling skills enhances your own fundraising journey.

Startups

Whether you are attracting pre-seed up to Series C funding, telling your company and product story in a visual deck is essential to successful capital raises.

As startup investors, founders, and consultants ourselves, we have a unique understanding of your investors' mind set.

Featured Services

With simple, flat-fee pricing, you choose the solution that puts your best foot forward on every investor first impression.

DO-IT-YOURSELF

Online Course

Research List

Instruction Guide

Canva Template

$350

DONE-WITH-YOU

Branded Template

3 Phone or Video Consultations

Unlimited Email Q&A Feedback

$950

DONE-FOR-YOU

DIY and DWY +

All-Inclusive Design

Research and Photography Consultations

Editable and Reusable Deck

Simple Flat Fee

Multiple Formats

$2500

Our Experience

As an investor and founder, Emma creates pitch decks with your investor at the forefront, using visual storytelling and financial projections to build credibility and trust with potential investors.

Emma has a bachelor degree in entrepreneurial management and a certificate in marketing graphic design, has been a content marketer for several businesses, and has created pitch decks attracting capital for tens of millions in commercial real estate and startups.

Hear From Our Clients

Raquel R.

"Visually stunning and compelling!"

Emma decks are exceptional!

She can take a vision and translate it into a visually stunning and compelling presentation!

Her design style is very professional and she pays attention to how the audience will receive the information. She ensures that the pertinent information is portrayed without overwhelming the readers. I highly recommend Emma to anyone looking for top-notch pitch deck design!

Ryan M.

"Institutional grade marketing touch!"

Emma brought an institutional grade marketing touch to a deal that we ultimately closed on together.

These marketing materials were paramount in our ability to source additional outside capital and articulate our business plan effectively to move the deal across the finish line.

George Owens

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque nisi nunc, tincidunt non nibh non, ullamcorper facilisis lectus. Sed accumsan metus viverra turpis faucibus, id elementum

Your Vision Designed

© 2026 Highrise Group Capital - All Rights Reserved, site and graphic designs are intellectual property and must be used with written permission.

© 2026 Company Name - All Rights Reserved